As a business owner, it’s important to have a clear vision for the future of your company. When you think about where you want your business to be in three, five or ten years, you need to consider factors such as market trends, economic conditions, customer demands, and technological advancements.

Is revenue growth and profitability on track to take your company to your next milestone?

Are you looking to expand your customer base, or introduce new products or services, but not sure where to start?

Do you have plans to purchase a business or sell your own business, yet unsure of the timing and steps?

Whether you’re looking to optimize your financial performance, improve your cash flow, or prepare for a major business transaction, consider these reasons that it may be time to hire a Fractional CFO.

Improve Profitability

People, processes, and technology all link to the ability of a company to be profitable. By providing expertise in financial management, a Fractional CFO can help improve your business’s bottom line by identifying and addressing inefficiencies in your financial operations and product and service pricing. They can assist in helping implement expense-controlling measures, identify areas that are inefficient, where you can cut back, negotiate better deals with suppliers, and streamline processes to improve time management and eliminate waste.

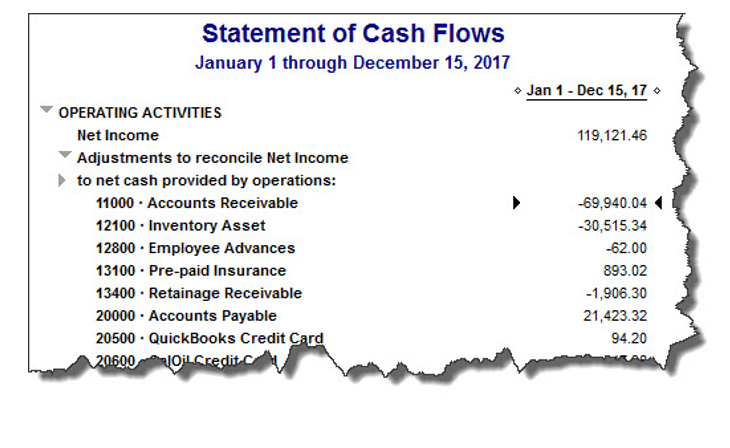

Optimize Cash Flow

A CFO will put an effective cash management system in place. By managing the cash cycle, the company improves collections, pricing, and terms; all adding to increased liquidity. This includes managing capital, debt obligations, and ensuring the ability to invest in new projects. A CFO can create a solid forecast, so you avoid being blindsided by the cash flow problems that accompany rapid growth. Furthermore, they will establish collection policies, payment terms with customers and suppliers, monitor inventory levels, and invest excess cash in profitable ventures.

Guide in Decision-Making

Without accurate financial data and insights, it can be difficult to make informed decisions. This is where a Fractional CFO can be a tremendous asset for your business. They can help you analyze your financial statements, identify trends, and provide insights to help you make better decisions such as where to best make investments, expand the business, roll out new products and/or service offerings. A CFO can provide objective and expert financial advice while building clarity around goals and action-plans to forecast and meet those financial goals, helping the business owner avoid costly mistakes.

Fund Your Growth

A Fractional CFO can help you access the necessary capital to fund your growth initiatives. They can work with you to identify potential sources of financing, such as loans, grants, or equity investments, and help you prepare the necessary documentation to secure funding. With their financial expertise and network of banking contacts, they can educate you on the best options for funding as well as help you take the necessary steps to increase your chances of obtaining the funding you need.

Mitigate and Manage Risk

CFOs, given their expanded role in establishing and executing strategy, have become well positioned to help ensure that a company’s risks are identified, assessed, managed, and integrated into the corporate strategy. A CFO has a keen understanding of the scope of risks that the organization faces by identifying the risks and classifying them by risk type (financial, compliance, debt, liquidity, operational and security risk). A Fractional CFO can help you establish internal controls, create financial policies and procedures, and ensure compliance with regulatory requirements. By taking a strategic approach to risk management, you can minimize financial losses and protect your business from potential legal and financial harm.

Assist in the Business Sale

If you are planning to sell your business, it is essential to have a solid exit plan in place. One of the primary benefits of hiring a Fractional CFO for your business transition is their expertise in financial planning. They can help you create a comprehensive financial road map to identify areas where you can improve your financial performance, thereby making the business more attractive to potential buyers. A Fractional CFO will assist in identifying potential buyers, assemble a team of experts (CPAs, attorneys, M&A firm), negotiate the terms of the sale, and ensure that the sale proceeds smoothly.

Overall, engaging the services of a Fractional CFO can be a game-changer for the business. Whether it’s developing a financial strategy, improving financial management practices, managing financial risks, or planning for growth or a business sale, a Fractional CFO can help businesses improve long-term value.

AE Tucker Consulting serves owners and management of small to midsize privately held companies to develop and implement strategy, improve cash flows, increase company value, and provide successful business transitions when the time comes.

Let’s start the conversation today on ways I can provide strategic financial guidance. Please schedule a discussion at a time convenient for you. Schedule–>

Andrew Tucker, CPA, CGMA, MBA

AETucker Consulting