As a business owner, it’s important to plan for financial success in the year ahead. One key step in this process is the disciplined approach to working on an annual business budget. It may seem like an obvious year end ritual; however, many business owners neglect this crucial step. Don’t let that be you!

Companies that regularly create and stick to a budget are more likely to be financially fit and meet their financial goals. A budget allows you to plan, identify areas where expenses can be cut, and ensure that you have enough cash flow to cover your expenses. When you assess where your business stands today, then develop budgets, financial models, tax strategies, and cash flow forecasts, you can be ready for any strong economic headwinds and adjust your sails accordingly as you pursue your business goals.

Budgeting Best Practices: How to Start

As you begin to create your business budget for 2024, it’s important to set clear revenue goals. This will help you determine how much money you need to generate in order to cover expenses and achieve your desired profits. To set your revenue goals, consider factors such as market trends, past performance, and industry benchmarks. It’s also important to be realistic and set goals that are challenging yet achievable. By setting clear revenue goals, you can create a more accurate and effective budget for your business in 2024.

Use Past Data

Creating a solid business budget requires a thorough and honest review of your 2023 budget and actuals. This will help you identify areas where you may need to adjust your spending or revenue expectations for the upcoming year. Additionally, consider any changes in the market or economy that may impact your business, and factor these into your budget planning.

Target Expenses

With economic uncertainty, skyrocketing costs, and supply shortages, it’s more important than ever to identify your fixed and variable costs. Fixed costs are expenses that remain the same regardless of your business’s level of production, such as rent, payroll and insurance. Variable costs, on the other hand, fluctuate based on production, such as materials and labor. By accurately identifying these costs, you can create a budget that allows for growth and profit.

Inflation is driving up the cost of goods and services. Additionally, salaries and payroll expenses are likely to increase over time, so it’s important to factor these into your budget as well. To ensure that your budget is accurate and effective, consider using historical financial data and consulting with industry experts. By carefully considering these factors and taking a collaborative approach, you can create a budget that sets your business up for success.

Monitor Cash Flow

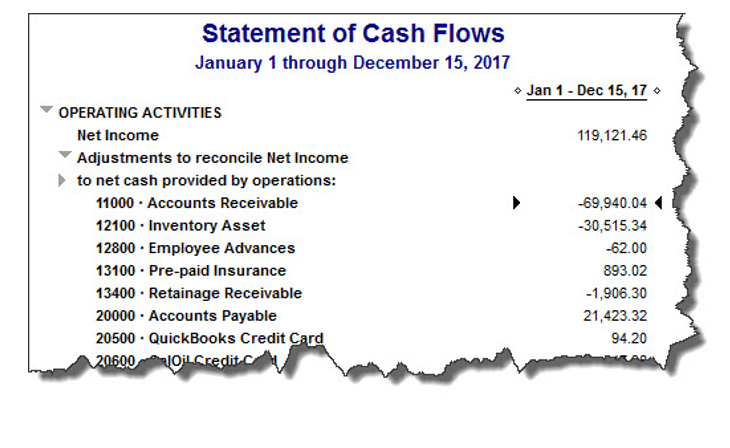

The cash flow statement is an important tool used in the budgeting process. Your cash flow statement provides valuable insights into the movement of money in and out of your business. By analyzing the cash flow statement from the previous year, you can identify patterns and trends in your business’s finances. The cash flow statement can also help to identify the months when your business has higher cash inflows and outflows, allowing you to plan accordingly.

Reduce Debt

A key step in the budget planning stage is assessing company debt. This will give you a better understanding of your financial situation and help you make informed decisions when it comes to allocating funds. Understanding your debt obligations is key to making decisions regarding investments, expenses, and revenue projections. By taking a thorough look at your company’s debt, you can identify areas where you can reduce costs, negotiate better terms with lenders, and optimize your cash flow.

Assessing your company’s debt will also give you a better understanding of your company’s financial health. You’ll be able to see how much of your revenue is going towards debt payments, and whether your debt load is sustainable in the long term.

Plan for Investments

Capital expenditures are expenses that are used to acquire or upgrade physical assets such as machinery, equipment, or property. These expenses are essential to keep your business competitive and efficient. By planning for capital expenditures in advance, you can ensure that you have the necessary funds available when you need them. This will help you avoid unexpected surprises and ensure that your business is well-prepared to succeed in the long run.

Additionally, planning for capital expenditures can help businesses to avoid unexpected expenses and prevent disruptions to their operations. It’s important during the budget process to allocate generously towards capital expenditures, especially if your goal in 2024 is to scale the business.

Reduce Tax Burdens

As you prepare your business budget for the upcoming year, it is crucial to consider the impact of taxes on your financial planning. Neglecting tax obligations can lead to unexpected expenses, penalties, and even legal issues. By accounting for taxes into your budgeting process, you can ensure that your business stays compliant with tax regulations while maintaining financial stability. This involves analyzing your income, expenses, and deductions to estimate your tax liability and setting aside funds for tax payments. By doing so, you can avoid last-minute scrambling and gain peace of mind knowing that your business is financially prepared for tax season.

Build Resilience During Emergencies

Every business owner knows that emergencies can happen at any time. Losing a major client, facing a recession, or needing to replace equipment and technology can all take a toll on your finances. That’s why it’s crucial to plan for contingencies when preparing your annual budget. Experts suggest setting aside 10% of your annual revenue as a good benchmark to help weather difficult times, but also ensure the long-term success of your business.

Be Transparent

As a company leader, you understand the importance of creating and sticking to a budget. However, ensuring that your entire team follows the budget can be a challenge. Be transparent about the company’s financial goals and challenges. Make sure everyone is aware of the budget and understands the consequences of not sticking to it. Ensure that the budget is achievable and realistic. Set clear targets and milestones and communicate them to your team. Keep track of expenses and check in regularly with your team to ensure that they are meeting their budget goals. Use reporting tools to create transparency and hold everyone accountable. Don’t forget to also celebrate when your team meets or exceeds their budget goals.

Leverage Fractional CFO Leadership

Budgeting is a crucial task that requires a lot of time, effort, and expertise. Planning and sticking to a budget is essential for the financial health and vitality of your business. However, creating an accurate and effective budget can be a daunting task, and mistakes can be costly. That’s why seeking professional advice when creating your company’s annual budget is highly recommended.

Fractional leadership can provide valuable insights and assistance in creating a budget that is tailored to your business’s specific needs and goals.

AETucker Consulting works with business owners and management of small to midsize privately held companies to develop and implement strategy, improve cash flows, increase company value, and provide successful business transitions.

Contact me to learn more about how we can help your business thrive.