Today, there are more than 30 million privately held businesses in the U.S. However, two out of every three new businesses will shut down during the first 10 years. Why? A recent study by U.S. Bank drilled down and discovered that 82% of the time, poor cash flow management or poor understanding of cash flow contributes to the failure of a small business.

Healthy cash flow isn’t simply earning more than you spend, nor is it about sitting on a pile of cash. It’s about ensuring your organization has sufficient cash flow to capitalize on new opportunities such as making investments in your company’s technology or infrastructure, hiring new talent, or expanding operations. It is also about having cash reserves to weather a crisis or economic downturn that negatively impacts your business.

Managing cash flow effectively will ensure you have the cash inflow you need to pay your employees, vendors, and other suppliers so you can get your products and services to your customers on time.

Proper cash flow management is a key strategy that every business owner must master for long-term financial success. First, let’s get a handle on just what is meant by the term cash flow.

Generally speaking, it can be separated into two categories: cash inflow and cash outflow. Cash inflow refers to the amount of money that is coming into your business and is being generated when you sell your products or services. Cash outflow, as the name suggests, is the money going out of your business. Regular expenses and debt payments would fall under the cash outflow category.

As a strategic business advisor and fractional CFO, I help implement and improve the cash flow management process for my clients. In this article, I share cash flow management advice that will strengthen your business and protect you from unexpected financial emergencies.

Start with Consistent Financial Reporting

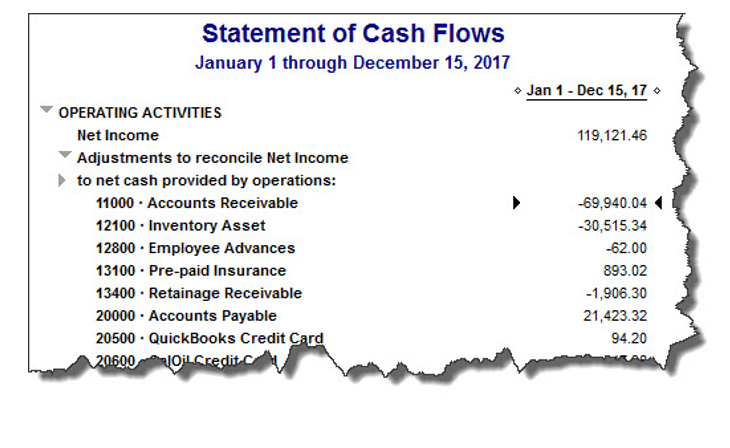

Your financial reporting and models should include a Balance Sheet, Income Statement (with projections), and Cash Flow Statement. These key financial tools should be monitored faithfully every month. The income statement solely will not uncover weaknesses in your company cash flow. Sure, a company may show a profit on the Income Statement, but without healthy cash flow, it cannot survive. After all, you pay your employees, bills, taxes and yourself from cash flow, not profits.

The most effective way to track your company’s cash flow is through a Cash Flow Statement. It enables you to get an overall view of money that has come in and gone out of your business’s bank account, and basically to understand your company’s cash position (whether it is positive or negative) every month. The first section of the cash flow statement is cash flow from Operations, which includes transactions from all operational business activities. Cash flow from Investing activities is the result of investments made in the business (think long term and fixed assets such as equipment and vehicles). Cash flow from Financing provides an overview of cash used from debt and equity. Below is a snapshot of a sample cash flow statement or report:

Create a Cash Flow Forecast

Cash flow forecasting involves estimating your future sales, expenses and investing activities (again think equipment and vehicles). Not only does a cash flow forecast help give you advanced notice of any problems that you may encounter in the future, but it also makes sure that you have the cash on-hand needed to fend off unexpected situations. It puts you in a better position to capitalize on opportunities and helps your business continue to scale and evolve over time.

These negative and positive cash flow swings don’t have to catch you off-guard because chances are there’s a pattern. If you perform a cash flow analysis, where you study your business history to identify trends, you can spot cash flow swings ahead of time and start preparing earlier.

Determine Your Borrowing Needs

By far, one of the most important ways to make sure you have a handle on your cash flow situation is to gain as much insight as possible into the money that you’re borrowing – and why. Most businesses need to take out loans for the needed capital for starting their business and operations and for further growth and expansion. However, pay careful attention to borrowing too much or borrowing from sources that are too expensive. If you have too many loans with a high-interest rate, you may be paying more each month than that money is actually bringing into your business. If you start to miss a payment or two, those interest rates could increase even further – causing you to take on additional debt just to stay afloat.

Maintain Cash Reserves

Cash reserves are important because they can help you protect your businesses by providing cash flow in the event that unexpected expenses arise or revenue drops. An emergency fund can help you cover expenses without having to get a loan or stacking up credit card debt. Additionally, having significant cash reserves provides a company the ability to make a large purchase— whether it be new equipment or real estate.

Monitor Your Receivables

Managing your accounts receivable to maximize cash flow is a critical aspect of operating your business successfully. By monitoring your accounts receivable, you can address an issue immediately if a payment is late. Sometimes it may be a simple oversight by your customer. It could also indicate a recurring trend; in which case you might need to decide on applying stricter credit terms or ending the business relationship altogether.

Some strategies to collect quickly on invoices include immediately sending your invoice after services or product is delivered. In addition, most accounts payable departments tend to make payments on weekly or biweekly intervals. The more time you give your customer to make their payment increases the likelihood your cash flow will remain steady.

Consider your terms. Credit terms are generally set as due upon receipt or due in a number of days, such as net 15 or net 30. You may need to consider specific factors about each customer; primarily, payment history. Giving your customer longer credit terms may positively affect the relationship but could negatively impact your cash flow.

Think about this – do you want to become a “bank” for your customers?

Improve Your Inventory Management

If you sell a product, your cash flow cycle depends on your inventory. You spend the cash you have to buy your inventory and that inventory turns back into cash when it sells. Consequently, your cash flow can easily be reduced by poor inventory management. Specifically, issues with stocking your supply and customer orders can lead to fewer sales which hurts your cash flow. Instead of buying more of what doesn’t sell, get rid of it—even if you need to sell it at a discount. This is where an inventory management software is beneficial. Meticulously track and manage your inventory flow, and you’ll have a firm grasp on your cash flow. There are many strategies you can take to manage inventory to boost cash flow. A business advisor can point you to some effective solutions and software.

Request an Upfront Deposit

Especially when you’re working with new customers, consider getting an upfront deposit before you begin to work on a project. That helps with your cash flow and also reduces the risk of miscommunication (discussing pricing and costs upfront will make sure both you and your client are on the same page.) Last but not least, deposits tend to scare away bad clients — the kind who would only hurt your cash flow in the long run anyway.

Consider Leasing Instead of Buying

Business owners can often avoid the large up-front costs of new equipment and other capital expenditure by renting instead. Leasing equipment for a fixed monthly fee will allow you to make smaller payments that don’t eat into your cash reserves.

Remember to consider the costs of repairs and maintenance of equipment the business owns when weighing up the benefits of leasing vs buying. Many commercial lease agreements include servicing, so if you’re spending a lot on technicians’ fees, leasing may be a better option.

Keep Out-of-Control Expenses at Bay

Ballooning expenses are one of the main reasons why company’s face cash flow struggles. Take a look at all the business services you’re paying for and stop the ones that aren’t absolutely necessary, at least temporarily. Review every line of your Profit & Loss Report and assess high expenses, what you can cut and how you can negotiate better pricing with suppliers.

In general, look for opportunities to reduce your operating costs as much as you can, at least for a little while. It can certainly help ward off any impending disaster and allow you to get back on your feet through a series of strategic financial moves in the days and weeks to come.

Work With a Financial Professional

Another one of the most common cash flow problems that business owners deal with in particular involves attempting to handle all aspects of this part of their business on their own. A financial professional with deep business experience that you trust not only will they be able to help you come up with an effective cash flow management strategy, but they can also put together essential documents like a cash flow statement and cash flow forecast data as well. The former paints a vivid picture of where you stand today, while the latter helps you see what you will achieve if you stay on the current trajectory.

The Bottom Line

Healthy cash flow is the result of operations that run efficiently and smoothly. While implementing some or all of the above steps should help you increase your business’s cash flow, you’ll also want to make sure you’re making the right decisions regarding your marketing, customer service, product or service development, and new customer acquisition.

If your business is experiencing cash flow problems or you want to talk over budgeting or other cash flow tips, reach out AETucker Consulting for a consultation. A growing business needs accurate and timely record-keeping and reporting. But if your needs have grown beyond basic bookkeeping and you need financial insights, accounting management, KPI tracking, and analysis, it’s time to hire a professional. AETucker Consulting is here to help!

Please contact me via email at Andrew@aetuckerconsulting.com and check out my website www.aetuckerconsulting.com.